MEET EU VAT LAW

Wherever you’re based, if you sell digital products to customers in the EU then your Easy Digital Downloads store must meet EU VAT rules. It’s the law!

COLLECT UK EU VAT

- Charges the correct VAT on sales to each EU country plus the UK

- Validates and stores customers’ VAT numbers

- Removes and reverse-charges VAT on B2B sales

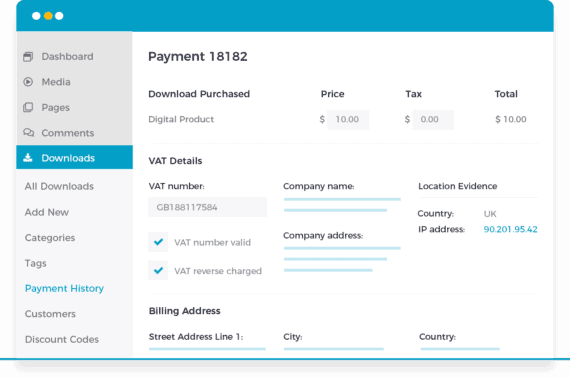

COMPILES CUSTOMER LOCATION EVIDENCE

- Works with EDD to store multiple location evidence

- Collects and displays the postal and IP address

- Easy to check and export evidence, ready for audit

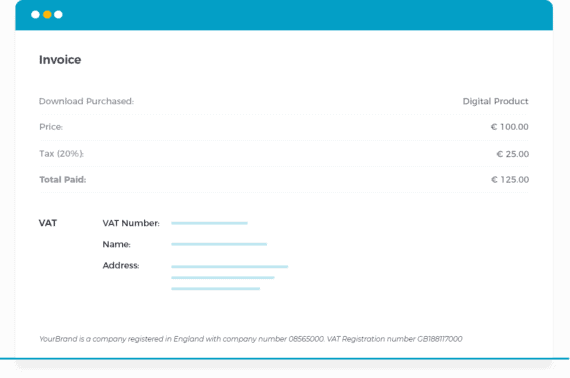

EASY VAT REPORTING INVOICING

- Adds EU/UK tax data to EDD payment confirmations

- Works with EDD payments, emails & PDF invoices

- Export instant reports for the MOSS tax return & EC Sales List

Charges the correct VAT

Automatically charges the correct EU and UK tax rates based on the user’s location, while reverse charging B2B sales

EU VAT compliant tax invoices

Makes the EDD invoices EU VAT compliant – purchase receipt emails, payment confirmation pages or Invoices

Built-in reporting

Generate instant reports of EU VAT collected – everything you need for the VAT/MOSS returns and EC Sales List

Audit-ready evidence

Brings together all the data required by UK and EU VAT law in one handy location, easy for you to view and export

Quick 2-minute setup

Instant plug and play – install the plugin and start charging the correct VAT and storing evidence immediately

Compatible with everything

Works with all WordPress themes, EDD payment gateways, Recurring Payments, Stripe, PayPal and more